The resource

Second-largest lithium ore deposit in the EU

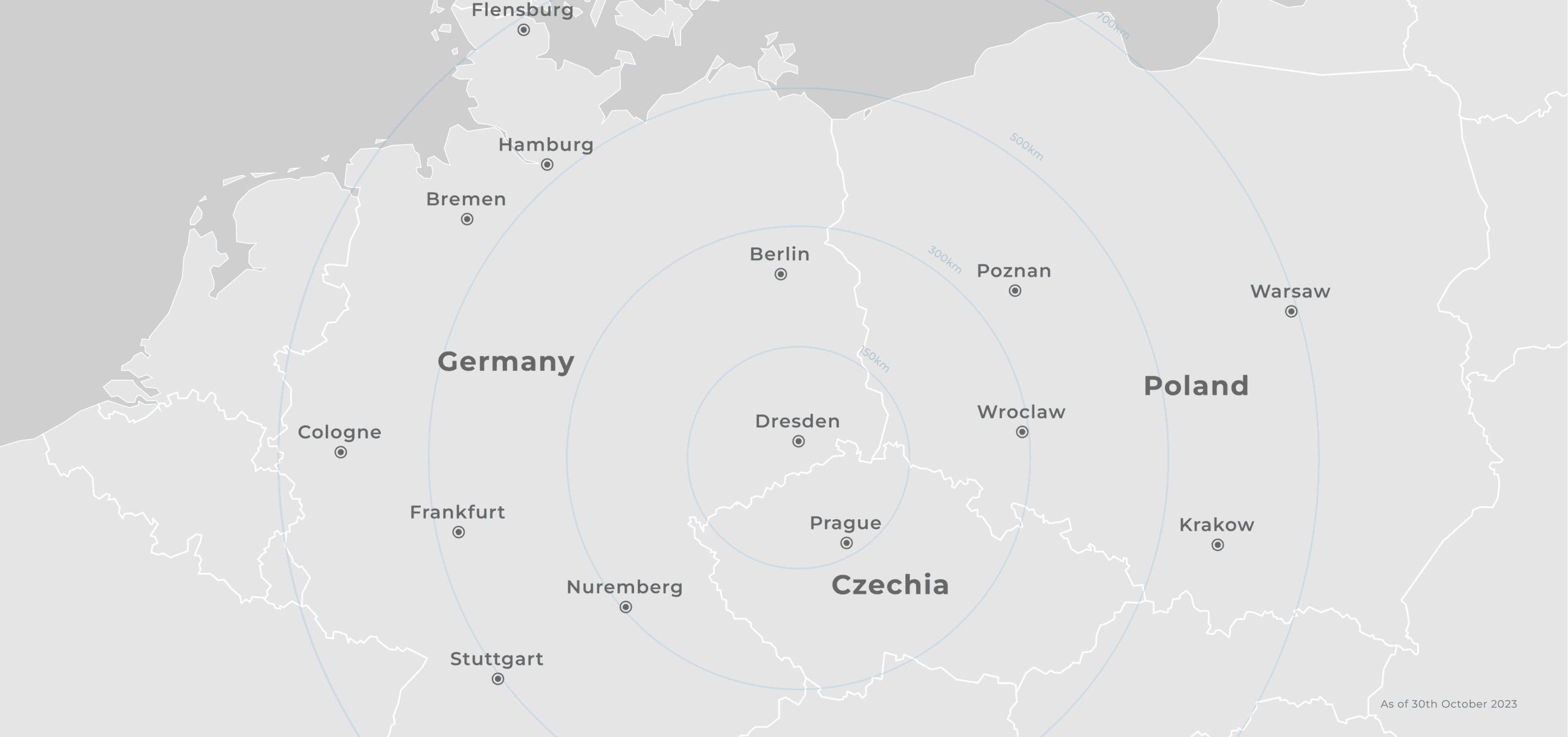

Located at the heart of Europe’s chemical and automotive industries, the Zinnwald Lithium project benefits from Saxony’s history of mining activity and existing infrastructure.

Located near Dresden in the east of Germany, the Zinnwald ore deposit is near the heart of Europe’s chemical and automotive industries, and 150 km from the nearest planned battery gigafactory.

Zinnwald Lithium Project

LG

DISTANCE: 300km

Umicore Poland Sp. z o.o. - Nysa

DISTANCE: 375km

DISTANCE: 640km

DISTANCE: 240km

DISTANCE: 245km

TESVOLT AG

DISTANCE: 240km

DISTANCE: 120km

SVOLT Modul- und Pack-Montage

DISTANCE: 685km

ACC - Automotive Cells Company

DISTANCE: 620km

Leclanché GmbH

DISTANCE: 660km

BorgWarner Akasol GmbH

DISTANCE: 530km

DISTANCE: 465km

DISTANCE: 250km

DISTANCE: 350km

DISTANCE: 650km

carbonate equivalent

pa at peak

per annum

of mine

The Zinnwald

ore deposit

Our project has the potential to be one of Europe’s largest lithium producers, with a Measured + Indicated + Inferred resource of 2,662,000 tonnes of lithium carbonate equivalent (LCE) according to the 2024 revised Mineral Resource Estimate (MRE).

The 2025 PFS outlines a two-stage development strategy, with Phase 1 targeting annual production of 18,000 tonnes of battery-grade lithium hydroxide. Phase 2 will build on this foundation, doubling output to a peak production of approximately 35,100 tonnes per year, while remaining within the original Phase 1 project footprint and providing a mine life of over 40 years.

To gain a more detailed understanding of the Zinnwald ore body, in 2022/23 we conducted an extensive drill programme. A total of 84 holes were drilled, each to a depth of about 300m (roughly equivalent to the height of the Eiffel Tower), extracting a total of 27 kilometres of core samples for analysis. The results of the study are laid out in the revised mineral resource estimate.

Mineral Resource Statement for Zinnwald Lithium Project

Effective 6th June 2024

| Classification | Domain | Tonnes | Mean Grade | Contained Metal | ||

| (Mt) | Li (ppm) | Li2O (%) | Li (kt) | LCE (kt) | ||

| Measured | External Greisen (1) | 11.3 | 3,420 | 0.736 | 39 | 206 |

| Mineralised Zone (2) | 25 | 2,090 | 0.449 | 52 | 277 | |

| Internal Greisen | 1.5 | 3,240 | 0.697 | 5 | 27 | |

| Mineralised Granite | 23.5 | 2,500 | 0.434 | 47 | 250 | |

| SubTotal (1) and (2) | 36.3 | 2,500 | 0.538 | 91 | 483 | |

| Indicated | External Greisen (1) | 2.1 | 3,510 | 0.756 | 7 | 40 |

| Mineralised Zone (2) | 155.1 | 2,130 | 0.459 | 331 | 1,762 | |

| Internal Greisen | 13.2 | 3,330 | 0.717 | 44 | 234 | |

| Mineralised Granite | 141.9 | 2,019 | 0.435 | 287 | 1,528 | |

| SubTotal (1) and (2) | 157.2 | 2,150 | 0.463 | 338 | 1,802 | |

| Measured + Indicated SubTotal | 193.5 | 2,220 | 0.478 | 429 | 2,285 | |

| Inferred | External Greisen (1) | 0.8 | 3,510 | 0.756 | 3 | 15 |

| Mineralised Zone (2) | 32.5 | 2,110 | 0.454 | 68 | 364 | |

| Internal Greisen | 0.6 | 2,880 | 0.620 | 2 | 9 | |

| Mineralised Granite | 31.9 | 2,090 | 0.450 | 67 | 355 | |

| SubTotal (1) and (2) | 33.3 | 2,140 | 0.461 | 71 | 379 | |

Source: Snowden Optiro

Potential

to expand

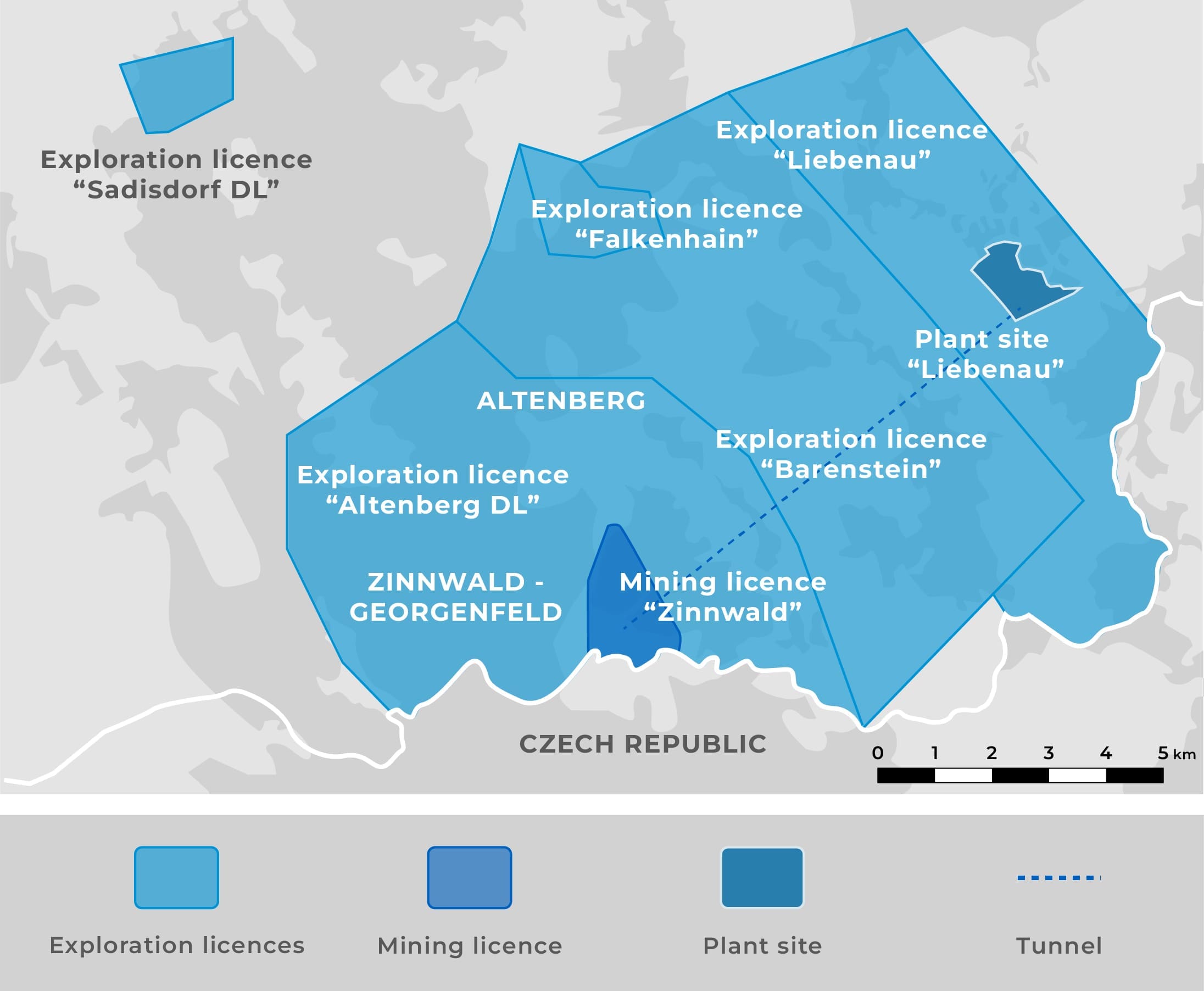

In addition to the area covered by the core mining license, we own the exploration rights for over 12,000 hectares in the area and are looking to identify additional lithium resources to extend the lifetime of the project.

Why

Zinnwald Lithium?

Zinnwald Lithium is seeking to build a world-leading, highly economic business that will uphold high environmental standards. Find out more about the investment case.